In Warren Buffets 2011 Letter to Shareholders, he recounts all of his successes but perhaps the biggest mistake Buffett copped to in his letter was being “dead wrong” about a housing recovery in 2011. “Housing will come back — you can be sure of that,” Buffett writes, but he no longer offers an opinion of when and his bet on five businesses directly tied to residential construction was “weaker than he hoped”.

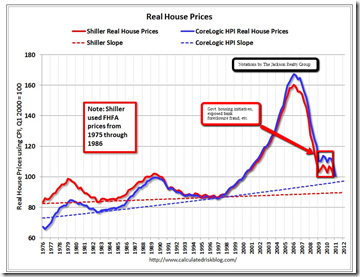

My guess is that Warren looked at the bump/stabilization in home value reports towards the end of 2010 and projected a recovery based upon that.

Take a look at the following 2 charts to see what happened:

In past boom/bust cycles (of not only housing) prices often overshoot to the downside…Looking at home values going forward there is a lot of evidence that the bottom is not yet here and steady appreciation is a ways off: there is a large overhang of vacant housing units and many distressed properties still to come… demand will remain soft as a consequence of ongoing weak employment, very tight mortgage financing criteria, negative home buying sentiment and a great deal of potential buyers excluded because of credit issues.

Note: usually near the end of a housing bust - after nominal prices stop falling - real prices decline slowly for a couple more years, and we will probably see that this time too. Of course, right now, nominal prices are still falling.

If you are in the market as either a seller, buyer or investor and would like to discuss your options, sale or purchase timing or anything housing related…call me on my direct line at 561-602-1258.

As always, thanks for reading….Steve Jackson