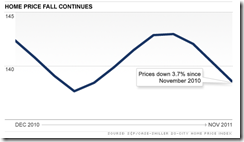

CNN: Unanticipated home price declines in November.

Prices are down 3.7% from a year ago, and off 32.8% since they peaked in the summer of 2006. The index is currently only 0.6% above its March, 2011 low. "Despite continued low interest rates and better real GDP growth in the fourth quarter, home prices continue to fall," said David Blitzer, spokesman for S&P.

The drop in home prices was more than housing bear Peter Morici, professor at the University of Maryland Smith School of Business, anticipated. He had forecast a 0.8% drop. "We've had more robust sales activity in the housing market lately," he said.

Morici thinks recent home price weakness stems at least partially from the fact that more sellers have accepted the weak market conditions and are putting their homes up for sale. Retirees and other home owners had postponed sales, trying to wait out the decline. "Sooner or later, you have to get rid of that house," he said.

Most difficult place to find another job? Florida!

The Sunshine State has the highest rate of long-term unemployment in the nation. Some 53% of jobless Floridians were out of work for more than six months in 2011, according to Brookings' Hamilton Project, which crunched Census data

"During the boom, the Florida economy was going gangbusters," said Sean Snaith, economics professor at the University of Central Florida. "We lost hundreds of thousands of jobs."

Although the market is starting to loosen up, there are four jobseekers for every open position in Florida, said Mason Jackson, chief executive of the WorkForce One career center in Fort Lauderdale. Businesses are still hesitant to hire because of continued uncertainty in the economy. "If we filled every job we could find, 75% would still be unemployed," Jackson said.

The housing market continues to weigh on the Florida economy and its job market. More than one in five borrowers are behind in payments, while 44% of homeowners owe more than their property is worth.

This prevents homeowners from moving away to look for work, said Tony Villamil, dean of St. Thomas University's School of Business in Miami.

"They are locked in their homes," he said.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

To any home owners reading this: If selling your home may be a consideration in the next 36 months, we should discuss the information contained in the two news releases, above, and the other housing and economic factors that may have an impact on your present and future real estate plans.

Call me directly at 561-602-1258

Thanks for reading…Steve Jackson