From the insightful blog Dr.Housing Bubble comes this recent post:

The biggest problem facing the housing market is still the large amount of stubborn shadow inventory. The fact that this figure remains elevated is a sign that the banking system after all these years and trillions of dollars in bailouts has yet to figure out a streamlined way to unload properties. The Federal Reserve is trying to grease the wheels with historically low mortgage rates but that has done very little since this does not address the weak economy. At the latest count there are 6.54 million loans that are either delinquent or in the foreclosure process. This figure hasn’t really moved much for the entire year. Properties have been sold from the REO (bank owned) pile but this is the tiny chunk of properties that is covered by the mainstream news and also that appear in public listing services. As we will show in charts later in this article, only examining this piece of the real estate pool is like seeing the tip of an iceberg and thinking there is nothing underneath it submerged in the water.

The stagnant shadow inventory

The latest data shows that the shadow inventory has increased a bit in the last few months:

To break down the figures even further you have 2.48 million loans that are less than 90 days delinquent (3 missed payments), 1.9 million loans that are 90+ days delinquent (more than 3 missed payments), and 2.16 million loans already in the foreclosure process. In total, this adds up to over 6.54 million loans in the distressed pipeline and this is what I would categorize as the shadow inventory. As the chart above highlights, only about 500,000 properties are actually real estate owned and show up for sale in local MLS data (and not all REO show up but a lot do). The cure rates are abysmal on many of the loans and many are underwater to levels that will never cure on these properties. In fact, the latest data shows that the typical foreclosure process timeline is now up to a stunning 599 days!

“(LPS) The July Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure timelines continue their steady upward trend, as a payment has not been made on the average loan in foreclosure in a record 599 days. Of the nearly 1.9 million loans that are 90 or more days delinquent but not yet in foreclosure, 42 percent have not made a payment in more than a year with an average delinquency of 397 days, also a new record. At the same time, first-time foreclosure starts in June were near three-year lows, and first-time delinquencies accounted for only 25 percent of new delinquent inventory.”

Even more disturbing you have 42 percent of the 1.9 million loans that are 90 or more days delinquent not making a payment in more than a year (approximately 798,000 mortgages are going with no mortgage payment for more than a year yet no foreclosure process has been initiated)…

Even though properties are being cleared out via REO sales, this is a small fraction of the pool and it also doesn’t include the fact that tens of thousands of people each month are thrown into the distressed pool because of the economy. This is why you have a tough battle ahead…

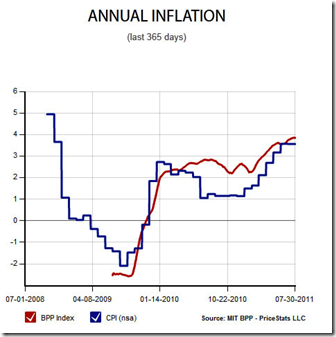

The hidden cost of living

Contrary to what we are being told the cost of living is going up. You have a variety of things happening from producers chopping down ounces or repacking goods giving you less for the same price to energy costs still being high (a gallon of gas here in L.A. County is stilling running over $3.8). You also have health premiums going up all the while people have no growth in household incomes. Yet the MIT data shows year-over-year inflation is now up over 4 percent. This figure is incredibly high when there is no added wage growth (even a 1 percent spike with no wage growth is crushing). You don’t need to be an expert here but just look at your monthly purchases to see this revealed.

The big ticket items like housing have been falling but for most other daily goods the cost has gone up. This is why the bigger issues that will push housing lower are outside of the housing arena (i.e., jobs, healthcare, education, food etc).

In my humble opinion, it becomes a cycle of continually-declining prices; As more REO sales happen, the comparable sales values pull down the rest of the market values, throwing more homeowners into an upside-down position. The further upside down an owner is, the more likely they are to stop throwing good money after bad, even before they hit a financial speed bump.

If you own a home here locally and are nearing “downsizing age” or have another compelling reason to consider selling your home in the near future and you currently are NOT upside-down, do it now. I can’t even count the number of owners I have met with, from 2007 through today, who have uttered the phrase”I’m not going to GIVE my home away!” I can guarantee that all of them would be ecstatic to sell their homes for the “give away” price I advised them of back when we first met.

And the people I meet with today who say “I’m going to wait until the market gets better” will be longing for the summer of ‘11.

If you’re reading this blog because you’re trying to figure out what your best option is…just call me and together we’ll figure it out. 561-602-1258

Thanks for reading,

Steve Jackson